Why a Money Management Class Should Be Required For Students

January 2, 2019

When you graduate high school you feel one way: great. You think of your future and you know, “I got this.” However, the truth is, you don’t.

You will feel good that you graduated and have a great life ahead, but one area that all teens – and many adults – struggle to understand is finances. This is why schools need to make financial management classes mandatory.

According to Daniel Bortz’s article “Why Most High Schoolers Don’t Know How to Manage Their Money” in US News and World Report, “A recent poll by Sallie Mae found that 84 percent of high school students desire more financial education. Among 16- to 18-year-olds, 86 percent said they would rather learn about money management in the classroom than make financial mistakes in the real world, according to a 2011 survey by investment bank Charles Schwab.”

Most students wants to know more about finances so that they can prevent making financial mistakes later in life. Most teens are extremely limited in their knowledge of basic money management and areas such as creating a budget or writing a check. This will affect them as adults because these are extremely important aspects of life that you need to know in order to be successful.

According to Zack Friedman’s article “Student Loan Debt Statistics In 2018: A $1.5 Trillion Crisis” in Forbes, “Student loan debt is now the second highest consumer debt category – behind only mortgage debt – and higher than both credit cards and auto loans. There are more than 44 million borrowers who collectively owe $1.5 trillion in student loan debt in the U.S. alone. The average student in the Class of 2016 has $37,172 in student loan debt.”

Of course, this debt is not simply the result of not understanding how to balance a checkbook, but it signifies just how important understanding money is for a generation that will undoubtedly have debt. Student loan debt is a big issue for most adults who went to college and cannot pay back the institutions that loaned them money.

According to Zack Friedman’s article “Student Loan Debt Statistics in 2018: A $1.5 Trillion Crisis” in Forbes, “On a percentage basis, the largest increase in student loan debt has come from a surprising age group: 60 to 69-year-olds, who have experienced an 71.5% increase in student loan debt. However, on a dollar basis, this age group represents a $35.6 billion increase over the same period, which is the lowest increase among all age groups. On a dollar basis, the highest increase in student loan debt is among 30 to 39-year-olds, who as a group now hold over $461 billion in student loans. On a percentage basis, the amount of student loan debt held by 30-39 year-olds has increased 30.2% over the past five years.”

Adults up to the age of 69 years old still have student loan debt from 30-40 years ago. The debt kept piling up year after year and eventually the money can not be payed off. This impacts their life negatively, especially if they had to take care of a child, did not have a well- paying job, tried to start a business or if they wanted to purchase a home. Student loan debt could make it 10x times harder for people who are trying to succeed in life. If schools made it mandatory for students to learn about money management, there is a high possibility that the percentage for student loan debts would decrease drastically.

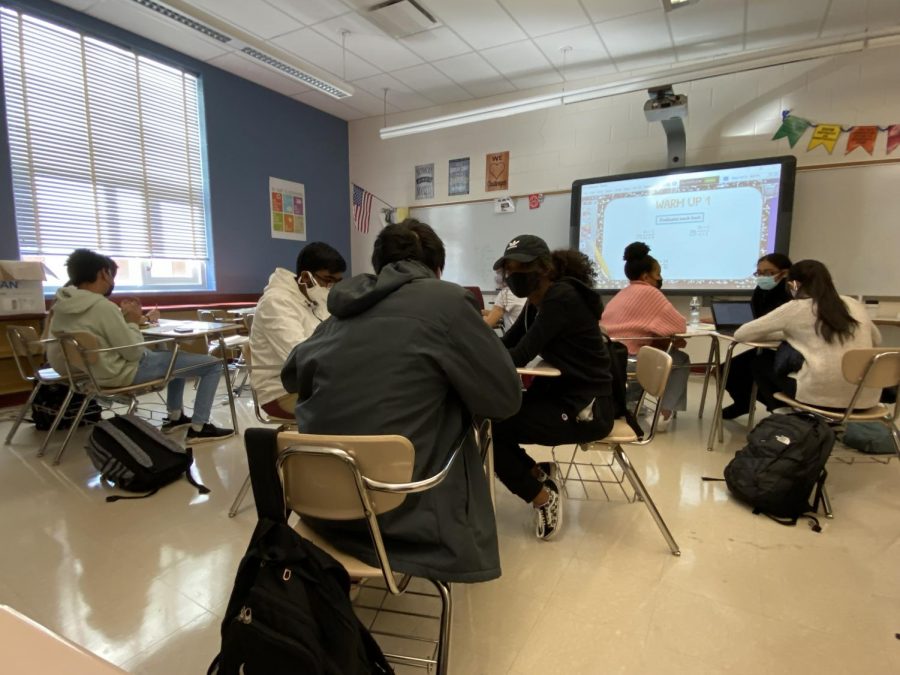

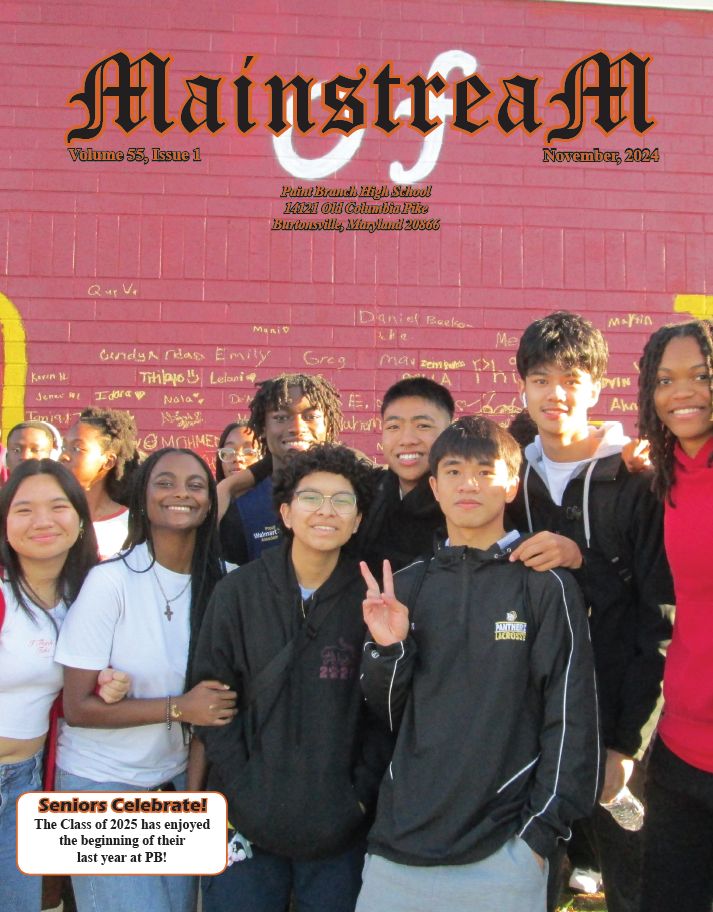

At Paint Branch High School, there is a business and finance department that prepares students for real-life experiences. PB has multiple programs for students that allows them to learn more about personal finances. According to the Academy of Finance’s profile, their mission, “addresses the needs of the financial services industry by providing high school students with the education required for success. There are multiple courses such as Entrepreneurship, Banking and Credit, Financial Planning and Accounting to help students learn the basics of personal finance.” Many schools across the nation are not as lucky as PBHS to be able to have these programs.

The issue of financial literacy needs to be taken seriously because it can really benefit students and prevent future financial mistakes that can impact their lives. Paint Branch and all MCPS schools should make it a priority to educate students on finance. There should be a mandatory course that is one semester long that teaches students how to fill out a checkbook, how to create a plan for college, how to set up a bank account, how to cash a check, and how to manage their bills once they get an apartment or house.