Kids and Credit Cards a Bad Mix

December 12, 2014

A majority of young people, especially children in this day and age, do not have a full understanding of credit cards, and most do not even fully grasp the concept of money.

Young people do not understand that money is, usually, obtained through hard work. Young people’s parents work countless hours to provide their families with a lifestyle that is comfortable. Children go to school every day and come home to food, shelter, and even new things without knowing what tasks were completed to allow this to happen.

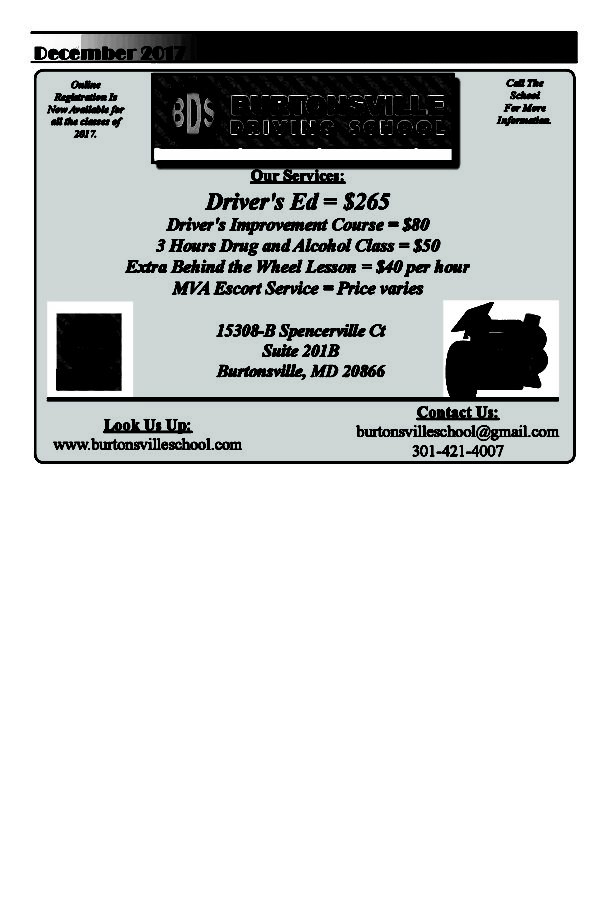

Kids can’t actually be issued their own credit cards until the age of 18 or above according to credit.about.com. They also state that the law requires the applicant to have a steady income before they qualify for a credit card. This is obviously for a good reason, as kids can’t be expected to responsibly manage a card with an interest rate for purchases that, essentially, works similar to a loan. Kids can be issued prepaid cards, which have a set amount of money, which means they can’t go over the limit on the card and do not deal with interest rates.

Janet Bodnar, a writer for Kiplinger Personal Finance, believes that kids using credit cards is a bad idea. According to Bodnar, allowing kids to use credit cards allow peoples’ children to make purchases when they are away from their parents, which gives them direct access to their parents’ funds discretely.

Another population of parents and adults that believe credit cards can be ultimately beneficial to kids. Rachel McMahon of the Huffington Post says, “Teaching our kids about money and credit will better prepare them for their financial future, and hopefully steer them away from the same financial mistakes we made when we were young adults.” McMahon believes that credit cards help children avoid financial mistakes in the future. Credit cards help the child gain experience for swiping cards but not really with managing money effectively.

Credit cards aren’t the only way to teach children how to use money responsibly. Cold hard cash can get the job done more effectively because the child can see exactly how much they have to spend. Daniel Bortz from usnews.com states, “Showing kids purchases with a credit card won’t do much good.” He then goes on to say, “A traditional one-slit piggy bank doesn’t teach kids much about money management, says Susan Beacham, chief executive and cofounder of Money Savvy Generation in Lake Bluff, Ill. So Beacham developed the Money Savvy Pig, a see-through piggy bank with four slots: save, spend, donate, and invest. With the Money Savvy Pig, kids learn that money isn’t just for buying things.” This teaches kids to save money but also not be selfish, to be good citizens and not just take from their community but also to give back.

These kinds of cards help big businesses grow as they deceive children. Bodnar notes that credit card companies use cards that entice kids as well. Bodnar see prepaid cards that are targeted toward children and have characters familiar to children like Transformers or Hello Kitty on them as negative. In fact, Consumer Reports noted in 2009 that the Senate developed a bill “forcing credit card issuers to adopt more consumer-friendly terms.” In fact, “Sen. Byron L. Dorgan, D-N.D., criticized a marketing pitch by a major issuer for a ‘Hello Kitty’ credit card aimed at children 10 to 14 years of age, saying, ‘I’d just love to know the person who thought this up and say, ‘Are you nuts? What on earth are credit companies doing soliciting young kids to get a credit card?’”

The early use of credit cards give kids the opportunity to make bad spending decisions, which can induce poor decision-making skills later on in life. Bodnar states, “Giving your kids credit cards is like letting them use drugs early so that they won’t turn into addicts.” Giving them credit cards just allows them to make these poor financial decisions early. Parents pay interest on the amount that their child used back to the bank. The bank makes a profit off of interest. Credit cards become a problem when people don’t pay the full amount each month or if they pay late. This type of behavior causes people to acquire low credit scores. Low credit scores warns banks that you aren’t good at paying money back on time or carrying a balance, which leaves banks feeling unsafe with leaving their money in your hands.